Look inside! - Free 40-page preview includes HISTORY OF MONEY, PORTFOLIO LOGIC, full Table of Contents, Preface.  click image to look inside | The Equity Premium Puzzle Intrinsic Growth & Monetary Policy by Robert Shuler "Getting these questions right [makes] a profound difference in the lives of nations and their people. ... Suppose

that the short term interest rate that was consistent with full

employment had fallen to -2 or -3% sometime in the last decade.

Then what would happen?" - Larry Summers, at IMF Economic Forum, Nov. 8 2013

Robert combines 50 years investing experience with the knack for finding hidden principles of a successful rocket scientist with half a dozen patents and several dozen publications in fields ranging from economics (corporate risk compensation, the equity premium) to physics (inertia & quantum gravity). He lives in Texas with his wife Natasha. Amazon author page - BOOK, EVENTS & COMMENTARY BLOG Available on Amazon (hardback / paper / Kindle) Barnes & Noble (ePub) Lulu (best place to order hardback) Special Ed. - released Dec. 2014 - buy here: eBook $3.99 - Paperback $6.48 |

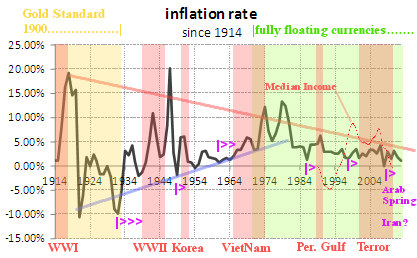

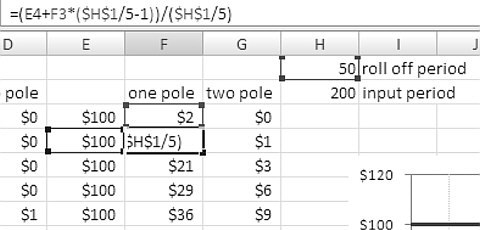

DEEP QUESTIONS  Did floating currencies after 1971 cause inflation or deflation? Did floating currencies after 1971 cause inflation or deflation?Does war cause spikes in inflation & declines in median income? Does recession and unemployment cause war? Did the gold standard or world trade cause 1929 depression?  The broken economy of Zo ... How would you fix it? Perpetual Portfolio Simulator (see book for instructions) click here  Spreadsheet with setup for 2-pole filter for financial data: click here   References (footnotes) with active links: click here examples: 1 Zheng, L., "A Survey of the Empirical Difficulties of the Consumption Capital Asset Pricing Models," J. Mod. Econ. Manag., vol. 2, no. 1 (2013). http://scik.org/index.php/jmem/article/view/665 2 Welch, I., Goyal, A., "A Comprehensive Look at the Empirical Performance of Equity Premium Prediction," The Review of Financial Studies, v. 21 n. 4, 2008 3 At least this is the theoretical view of economists. For example, see Zheng, L., "A Survey of the Empirical Difficulties of the Consumption Capital Asset Pricing Models," Journal of Modern Economy & Management, vol. 2, no. 1 (2013) available open access at http://scik.org/index.php/jmem/article/view/665 4 Mehra, R. and Prescott, E., "The Equity Premium A Puzzle," Journal of Monetary Economics, North-Holland, 15, 145-161 (1985) http://www.academicwebpages.com/preview/mehra/publications/ | READER COMMENTS & REVIEWS truly fascinating - N. Mosley, UBS Sr. VP page turner - B.G. Smith, NASA engineer amazing sense of humor - C. Wolfe, investor/artist The

book presents a theory of necessity to adjust money supply to account

for productivity if deflation is to be avoided. The monetary agent

(central banker) is a market participant who is not profit oriented and

can create money at will, and thus not be subject to rational investor

constraints. The monetary agent's power is similar to or greater than

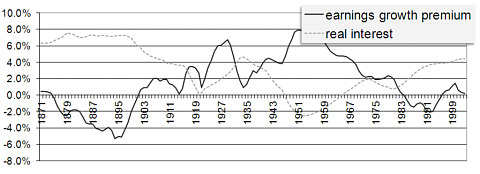

investor power in the market. Businesses leverage low interest rates enforced by the monetary agent to increase their activity, and growth rates, increasing employment to compensate for the reduced labor necessary to create the former level of goods and services. This leveraged difference in returns is the equity premium. Since productivity is a "rate" of production, even a one time increase requires a corresponding permanent increase not in the money supply itself, but in the "rate of increase" of the money supply. Given the steady growth in productivity of the last 100 years, the world economy is now grossly under-stimulated and in danger of precipitous deflation. Both academic models and arguments based on historical events are presented, along with analysis of the meaning of money, investor behavior, and practical techniques for obtaining the equity premium in one's portfolio. FROM THE BACK COVER Do you believe the FED is ruining our money?

What is the

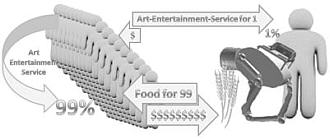

EQUITY PREMIUM? Market index stocks return 7% to 8% MORE than bonds

GROWTH cannot be equalized by prices From the Book: On the origin & history of money On monetary policy & FED tapering On working class transition to self-sufficiency “The transition to investor self-sufficiency is not only doable, I know people who are doing it.” On wages vs. human value On the causes of war “Pre WWII Germany is not a similar situation to the modern debt of weaker European nations, and the German paranoia about inflation is harmful in the current context. Technically it was unemployment, not inflation, that caused extreme hardship in Germany, and it is unemployment in the weaker European nations that is being fostered by German monetary policy. ... Unemployment in Germany reached 33.7% in 1931 and 40% in 1932. In 1933, the same year that Roosevelt took office and confiscated American's gold, repudiating the gold standard internal to the U.S., world trade fell to 1/3rd of its former value and Hitler came to power and repudiated the reparations. Germany quickly reversed its economic fortunes and became a major industrial power. But the political damage was already done, and it used its power to wage global war. ” “The blind following of emotional attachments rather than the true historical meaning of money rooted in mutual exchange leads to mistakes in monetary policy - mistakes that have serious consequences.” Example of the transition to self-sufficiency Copyright © 2013 Robert Shuler - All Rights Reserved |

.